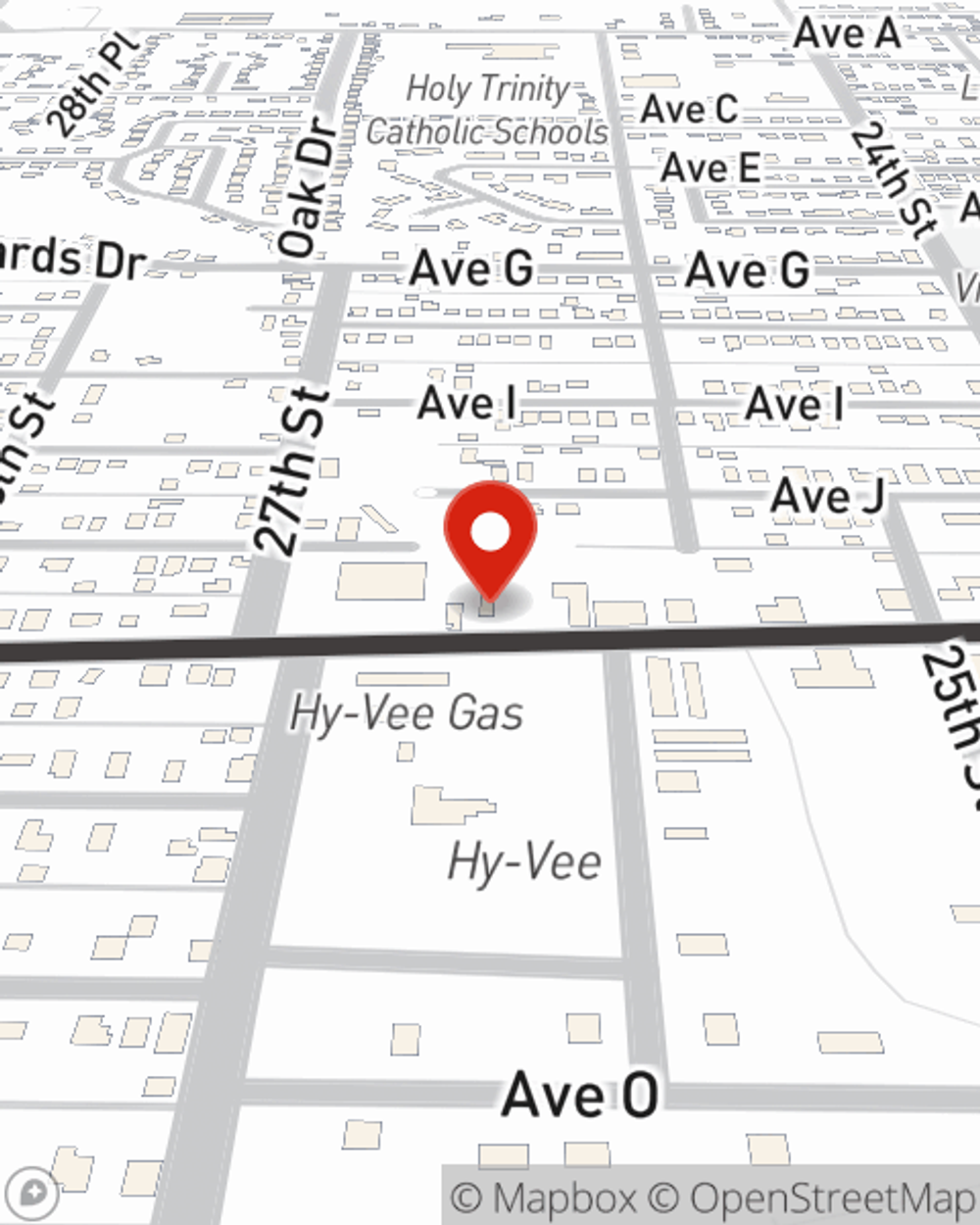

Business Insurance in and around Fort Madison

Get your Fort Madison business covered, right here!

Cover all the bases for your small business

- Fort Madison, IA

- Niota IL

- Nauvoo, IL

- Kahoka, MO

- Lee County IA

- Van Buren County IA

- Hancock County IL

- Iowa

- Illinois

- Missouri

- SE Iowa

- Des Moines County IA

- Bonaparte IA

- Wever IA

- Hamilton IL

- Keokuk IA

Help Prepare Your Business For The Unexpected.

Whether you own a a home cleaning service, a tailoring service, or a hair salon, State Farm has small business insurance that can help. That way, amid all the different decisions and moving pieces, you can focus on navigating the ups and downs of being a business owner.

Get your Fort Madison business covered, right here!

Cover all the bases for your small business

Cover Your Business Assets

Your business thrives off your commitment determination, and having great coverage with State Farm. While you make decisions for the future of your business and support your customers, let State Farm do their part in supporting you with worker’s compensation, artisan and service contractors policies and commercial liability umbrella policies.

The right coverages can help keep your business safe. Consider getting in touch with State Farm agent Jess Sutcliffe's office today to learn about your options and get started!

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Jess Sutcliffe

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".